Solar Energy Tax Credit Extended

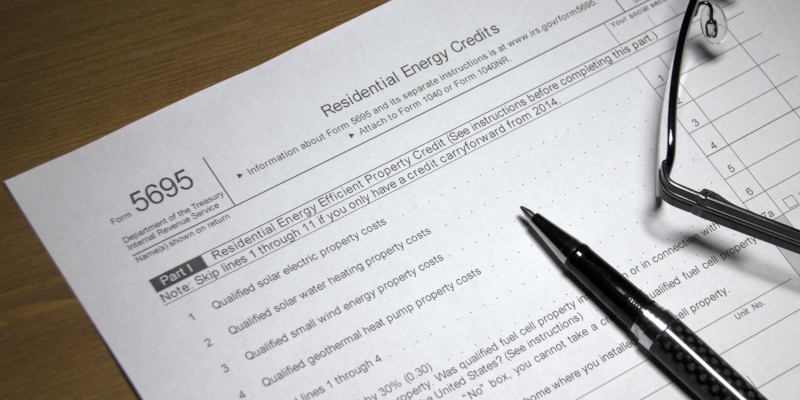

With all the negative effects that the pandemic has had on our nation, it is always nice to learn about some good things. One that you might not be aware of is the two-year extension of the federal Investment Tax Credit, as provided by the Consolidated Appropriations Act, 2021. The credit was slated to be reduced to 22 percent in 2021, but this extension keeps the credit at 26 percent through 2021 and 2022. It will drop to 22 percent for 2023. After that time, you can only get a 10 percent tax credit on large-scale solar energy projects.

What all this means is that it isn’t too late to invest in solar energy and have a big chunk of your investment immediately realized as a credit on your 2021 tax return. To qualify for the credit, the solar energy system can be installed on your primary or secondary residence. You are allowed to have the project financed, so you could get the credit without pulling funds out of your savings if desired.

Keep in mind that a tax credit is much better than a tax deduction. Your tax liability is reduced rather than your taxable income. Everyone benefits the same from a tax credit, regardless of your income tax rate.

With innovative advancements in solar energy, the cost to install solar panels is more affordable than ever. When you combine this with the extended federal tax credit, there has never been a better time to consider having a solar power system installed at your home.